When Bitcoin burst onto the scene in 2009, it was hailed as the first decentralized cryptocurrency, sparking a revolution in how we perceive and use money. However, as the blockchain technology underlying Bitcoin proved its potential, a new player emerged to expand its capabilities: Ethereum. While both Bitcoin and Ethereum operate on blockchain technology, they serve different purposes and offer unique functionalities. Let’s dive into what Ethereum is and how it distinguishes itself from Bitcoin.

Understanding Ethereum

Ethereum is more than just a cryptocurrency; it’s a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Created by Vitalik Buterin and launched in 2015, Ethereum introduced the concept of programmable blockchain, allowing for more complex and versatile use cases beyond simple financial transactions.

At its core, Ethereum operates on its native cryptocurrency called Ether (ETH). While ETH functions similarly to Bitcoin in that it can be used as a medium of exchange and a store of value, its primary role within the Ethereum ecosystem is to facilitate transactions and incentivize developers to create and maintain decentralized applications. This added layer of functionality makes Ethereum a foundational element for a wide range of blockchain-based innovations.

For a comprehensive overview of Ethereum’s capabilities, you can visit Ethereum’s official website.

Smart Contracts: The Heart of Ethereum

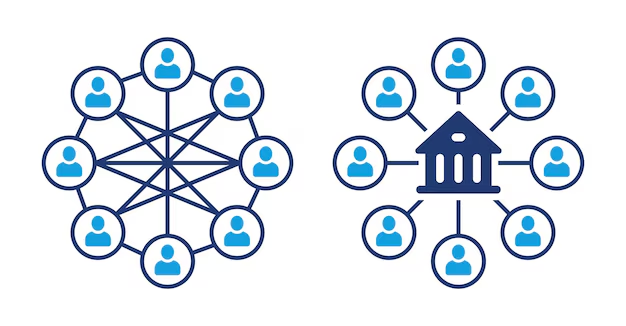

One of the most significant innovations introduced by Ethereum is the concept of smart contracts. Smart contracts are self-executing contracts with the terms directly written into code. These contracts automatically enforce and execute agreements when predefined conditions are met, eliminating the need for intermediaries like lawyers or escrow services.

Imagine a scenario where you want to rent an apartment. Instead of relying on a landlord or property management company to handle the transaction, a smart contract can automatically transfer the rental fee to the landlord and provide you with access to the property once the payment is confirmed. This automation not only reduces costs but also increases transparency and efficiency.

Smart contracts have paved the way for a plethora of decentralized applications, ranging from finance (DeFi) to gaming and supply chain management. By enabling trustless interactions between parties, smart contracts have revolutionized how agreements are made and enforced in the digital age.

Ethereum vs. Bitcoin: Key Differences

While Bitcoin and Ethereum share the foundational blockchain technology, their purposes and functionalities diverge significantly. Here are some key differences that set Ethereum apart from Bitcoin:

- Purpose and Vision:

Bitcoin was primarily designed as a decentralized digital currency, aiming to provide an alternative to traditional fiat money and serve as a store of value. Ethereum, on the other hand, was created as a decentralized platform for running smart contracts and building dApps, with the vision of becoming a “world computer” that can execute any program without downtime or interference. - Transaction Speed and Fees:

Ethereum generally offers faster transaction times compared to Bitcoin. While Bitcoin transactions can take anywhere from 10 minutes to an hour to confirm, Ethereum transactions are typically confirmed within seconds to a few minutes. However, both networks can experience congestion, leading to higher fees during peak times. - Consensus Mechanism:

Both Bitcoin and Ethereum currently use Proof of Work (PoW) as their consensus mechanism, which involves solving complex mathematical problems to validate transactions and secure the network. However, Ethereum is in the process of transitioning to Proof of Stake (PoS) with its Ethereum 2.0 upgrade, which aims to improve scalability, reduce energy consumption, and enhance security. - Supply Cap:

Bitcoin has a fixed supply cap of 21 million coins, making it inherently deflationary. Ethereum does not have a fixed supply, and its issuance rate is subject to change based on network upgrades and community consensus. This difference affects how each cryptocurrency is perceived as a store of value. - Development and Innovation:

Ethereum’s platform is more flexible and programmable than Bitcoin’s, allowing for continuous development and the creation of new applications. This has led to a vibrant ecosystem of projects and innovations, making Ethereum a hub for blockchain-based development.

For a detailed comparison between Ethereum and Bitcoin, check out CoinDesk’s Ethereum vs. Bitcoin Guide.

The Importance of Ethereum in the Blockchain Ecosystem

Ethereum plays a pivotal role in the broader blockchain ecosystem, serving as the foundation for numerous decentralized applications and financial instruments. Its ability to support smart contracts has unlocked a range of possibilities that extend far beyond simple transactions.

Decentralized Finance (DeFi):

One of the most prominent use cases of Ethereum is in the decentralized finance sector. DeFi platforms allow users to lend, borrow, trade, and earn interest on their crypto assets without relying on traditional financial institutions. These platforms leverage smart contracts to automate processes and ensure security, providing users with greater control over their finances.

Non-Fungible Tokens (NFTs):

Ethereum is also at the forefront of the NFT movement. NFTs represent unique digital assets, such as art, music, and virtual real estate, and are created and traded on the Ethereum blockchain. This has revolutionized how digital ownership is perceived and has opened new avenues for creators and collectors alike.

Decentralized Applications (dApps):

Ethereum’s programmable nature has enabled the development of a wide array of dApps across various industries. From gaming and social media to supply chain management and healthcare, dApps built on Ethereum are transforming traditional business models and fostering innovation.

Challenges and Future of Ethereum

Despite its significant contributions to the blockchain space, Ethereum faces several challenges that need to be addressed to realize its full potential.

- Scalability:

As the number of users and applications on Ethereum grows, the network can become congested, leading to slower transaction times and higher fees. Ethereum 2.0 aims to tackle this issue by introducing shard chains and transitioning to Proof of Stake, which will enhance the network’s capacity and efficiency. - Security:

While smart contracts offer immense potential, they also introduce new security vulnerabilities. Bugs or flaws in smart contract code can lead to significant financial losses. Ensuring robust security measures and conducting thorough audits are crucial for maintaining trust in the Ethereum ecosystem. - Regulatory Uncertainty:

Like all cryptocurrencies, Ethereum operates in a landscape of evolving regulations. Clear and supportive regulatory frameworks are essential for fostering innovation and encouraging mainstream adoption while protecting users from potential risks.

Looking ahead, Ethereum’s ongoing upgrades and the community’s commitment to innovation position it well to continue leading the charge in blockchain technology. Its versatile platform and active development community are key factors that will drive its growth and adoption in the years to come.