Bitcoin has become a household name in the world of finance and technology, but what exactly is it? At its core, Bitcoin is a digital currency that operates without the need for a central authority, such as a government or bank. Created in 2009 by an anonymous individual or group known as Satoshi Nakamoto, Bitcoin was designed to offer a decentralized alternative to traditional money.

Understanding Bitcoin

Bitcoin is a type of cryptocurrency, which means it uses cryptographic techniques to secure transactions and control the creation of new units. Unlike physical currencies like the dollar or euro, Bitcoin exists entirely online. You can send and receive Bitcoin through digital wallets, which store your private keys—essentially your personal passwords that grant access to your Bitcoin.

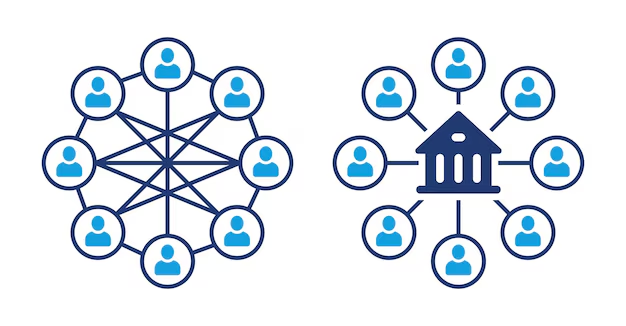

One of the key innovations behind Bitcoin is the blockchain. The blockchain is a public ledger that records all Bitcoin transactions. Every transaction is verified by a network of computers, known as nodes, ensuring that the system remains secure and transparent. This decentralized verification process eliminates the need for intermediaries, such as banks, allowing for peer-to-peer transactions.

For a more detailed explanation of how Bitcoin works, you can visit Bitcoin’s official website.

Why Bitcoin Matters

Bitcoin’s importance extends beyond being just another digital currency. Here are a few reasons why Bitcoin matters in today’s world:

- Decentralization:

Unlike traditional currencies controlled by governments and financial institutions, Bitcoin operates on a decentralized network. This means no single entity has control over the entire system, reducing the risk of censorship and interference. - Limited Supply:

Bitcoin has a finite supply of 21 million coins, which makes it resistant to inflation. Unlike fiat currencies, which can be printed in unlimited quantities, Bitcoin’s scarcity can potentially increase its value over time. - Financial Inclusion:

Bitcoin provides access to financial services for people who are unbanked or underbanked. With just an internet connection, anyone can send, receive, and store Bitcoin, bypassing the need for traditional banking infrastructure. - Security and Transparency:

The blockchain technology underlying Bitcoin ensures that all transactions are secure and transparent. Once a transaction is recorded on the blockchain, it cannot be altered or deleted, providing a high level of trust and integrity.

Bitcoin as an Investment

Many people are drawn to Bitcoin as an investment opportunity. Here’s why Bitcoin is considered by some as a valuable addition to their investment portfolios:

- Store of Value:

Often referred to as “digital gold,” Bitcoin is seen as a store of value that can hedge against inflation and economic instability. Its limited supply and decentralized nature make it an attractive option for preserving wealth. - High Returns:

Bitcoin has shown the potential for significant returns over the years. While it is highly volatile, early investors have seen substantial gains, which continues to attract new investors looking for high-risk, high-reward opportunities. - Diversification:

Including Bitcoin in an investment portfolio can provide diversification benefits. Since Bitcoin’s price movements are not always correlated with traditional assets like stocks and bonds, it can help spread risk and enhance overall portfolio performance.

For insights on Bitcoin investing strategies, check out this guide by Investopedia.

The Future of Bitcoin

Bitcoin’s future remains a topic of much debate and speculation. Some believe it will continue to gain mainstream acceptance and become a fundamental part of the global financial system. Others are concerned about regulatory challenges and the potential for technological hurdles to impede its growth.

- Regulatory Landscape:

Governments around the world are still figuring out how to regulate Bitcoin and other cryptocurrencies. Clear regulations could provide legitimacy and encourage wider adoption, while strict regulations might limit its use and impact its value. - Technological Advancements:

Improvements in blockchain technology and the development of the Lightning Network aim to make Bitcoin transactions faster and more scalable. These advancements could enhance Bitcoin’s usability for everyday transactions and further solidify its position in the market. - Institutional Adoption:

Increasing interest from institutional investors and major companies could drive Bitcoin’s growth. As more businesses accept Bitcoin as a form of payment and investment, its legitimacy and demand are likely to increase.

For a comprehensive overview of Bitcoin’s potential future, visit CoinDesk’s Bitcoin Future Analysis.

Challenges Facing Bitcoin

Despite its potential, Bitcoin faces several challenges that could impact its adoption and value:

- Volatility:

Bitcoin’s price is highly volatile, which can be a barrier for both investors and everyday users. Significant price swings can lead to uncertainty and risk, making it difficult to use Bitcoin as a stable store of value or medium of exchange. - Scalability:

As more people use Bitcoin, the network can become congested, leading to slower transaction times and higher fees. Scalability remains a critical issue that needs to be addressed to support widespread adoption. - Environmental Concerns:

Bitcoin mining, which involves solving complex mathematical problems to validate transactions, requires substantial computational power and energy consumption. This has raised environmental concerns and calls for more sustainable mining practices. - Security Risks:

While the blockchain itself is secure, Bitcoin exchanges and wallets can be vulnerable to hacking and fraud. Ensuring robust security measures is essential to protect users’ investments.

Bitcoin has undeniably made a significant impact on the financial landscape, introducing a new paradigm of decentralized digital currency. Its unique features, such as limited supply, decentralization, and the underlying blockchain technology, set it apart from traditional currencies and investment options. While Bitcoin offers numerous benefits and opportunities, it also comes with challenges that need to be navigated carefully.

Whether you’re considering investing in Bitcoin, using it for transactions, or simply curious about its role in the future of finance, understanding what Bitcoin is and why it matters is crucial. As the cryptocurrency space continues to evolve, Bitcoin remains at the forefront, driving innovation and shaping the future of money.